Most Popular

IDF expands operations in Gaza, flattens Hamas command center

After Months of Silence, the Truth Explodes: What Really Happened at the Nova Festival

Iran's military personnel leave Yemen - Houthis' collapse imminent

Trump: Netanyahu may visit U.S. next week

France warns of imminent war with Iran

Most Popular

Next Year In A Peaceful Jerusalem

Benjamin Netanyahu to Hungarian Jewish community: "With God's help, we will win in the near future" | WATCH

From hostage to heroine

Back from captivity, Karina Ariev opens Jerusalem’s iconic marathon

Deserted by the IDF

October 7th probe: How Kibbutz Nirim was abandoned by IDF during Hamas assault

Facing total collapse

Hamas is in total disarray: Leadership struggles after key assassinations

Stealing for Heaven

Parshas Vayikrah: The paradox of the stolen Korban Olah

We'll See If They're Right

Qatar denies involvement in Qatargate

Maybe They'll See To The Penguins

Trouble in China: Iran facing difficulty in selling oil to best customer, thanks to Trump

Hollywood’s Race Narrative Takes Another Turn

Star Wars actor slams fans as “white elitists” in unhinged racial tirade

Play Stupid Games, Win Stupid Prizes

D'oh! Bernie Sanders' anti-Israel resolution doesn't even get 20 votes

A Lesson In Boundaries And Self-Respect

"No one is coming to us for the holiday, consider it canceled," I informed Milka, and she was horrified | A moving story

Gaza’s second week of protests demands ‘Hamas out’ as grip weakens

Jerusalem unveils 350,000 square meter first station development plan

Nicaragua withdraws support from South African "genocide" case against Israel in ICJ

IDF's New Spokesperson Makes First Statement to the Media; Here's What He Said

NYPD boosts Synagogue security for Passover amid anti-Semitic crime surge

The NYPD is enhancing security at synagogues and Jewish institutions across New York City ahead of Passover, addressing a 7% rise in antisemitic hate crimes in 2024, which now constitute 62% of all hate incidents, including violent attacks and vandalism. Commissioner Jessica Tisch and the Hate Crimes Task Force are coordinating with community leaders to ensure safety, amid growing fears among Jewish New Yorkers following incidents like subway assaults and swastika graffiti.

"No Entry for Haredim," shocking anti-Semitism revealed across the U.S as towns seek to 'restrict' religious populations

Women as bitter herbs in historical Haggadot: Family strife as portrayed during the seder

Jewish community center in Colorado hit by shocking antisemitic attack

Fortnite and the Holocaust: A new way to teach Gen Z about history?

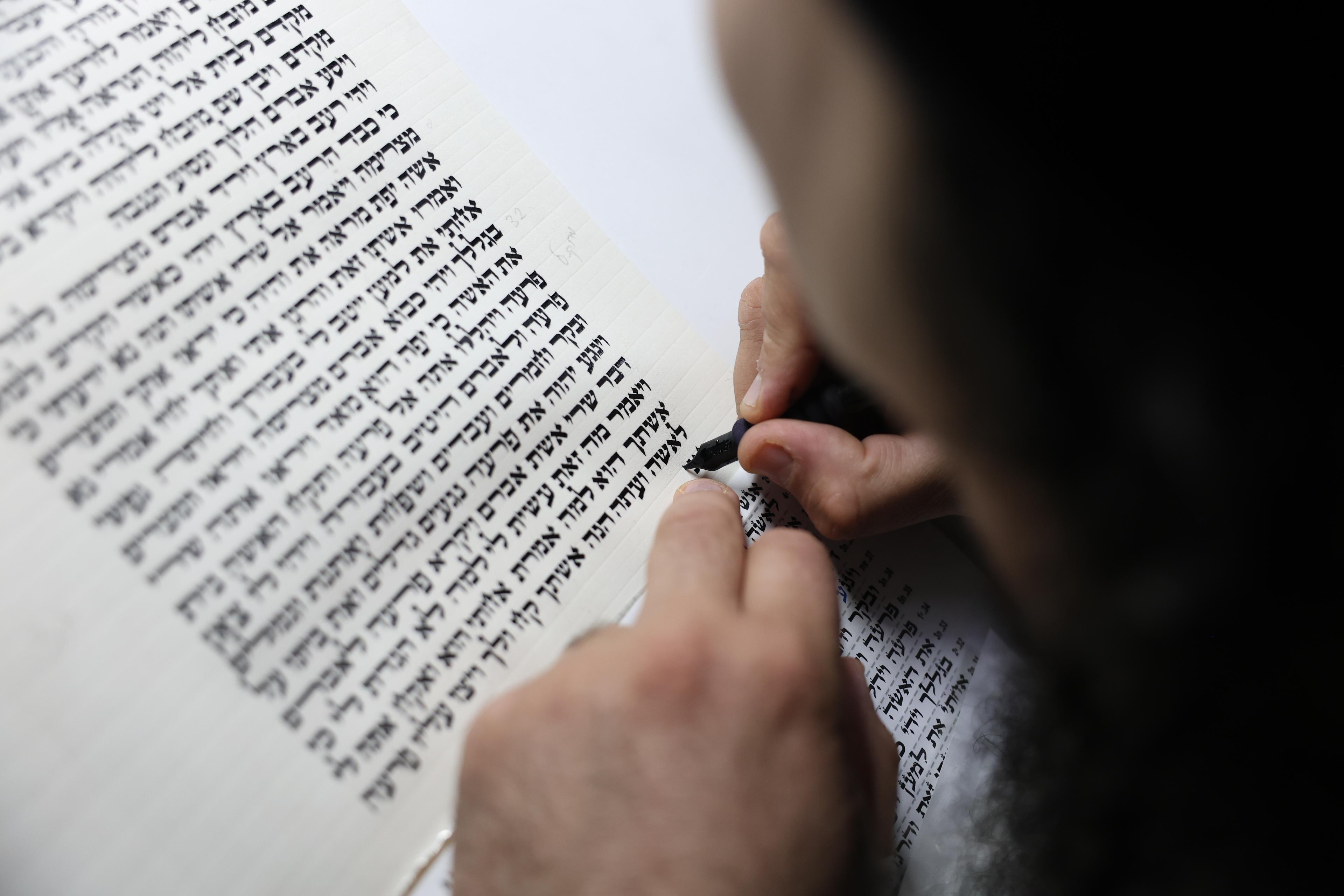

Lakewood teens complete Shas in memory of the Bibas family

Meet Sharona Nazarian: First Jewish Iranian female mayor in US history

How to clean for Pesach in a day: A guide to a joyful and stress-free preparation

The Deep State: Between sociological reality and Israeli irony

While his supporters decry its influence, and his opponents deny its existence, few are willing to admit the uncomfortable truth: Israel’s deep state reached its peak under Netanyahu — with his full cooperation.

Netanyahu’s Secret October 6 Triangle Exposed: War Without Victory, Division Without End, and a Failing Strategy of Refusal

As Israel’s war drags on without resolution, Netanyahu’s political survival tactics deepen national fractures — turning military fatigue, public frustration, and forced loyalty into tools of control.

ATALAR for Cruise-Missile Defense Sensor-Grid

The monster they created: How Israel’s Deep-state turned against Its master

For decades, the Likud party empowered Israel’s unelected judicial elite. Now, with the Shin Bet defying the Prime Minister, Netanyahu may finally be facing the system he helped build — and for the first time ever he is fighting back.

Discover Ein Gedi: The desert oasis you’ll wish you’d visited sooner

Nestled along the shores of the Dead Sea, Ein Gedi is a breathtaking oasis in the Judean Desert, blending natural splendor with rich history. This nature reserve, just 90 minutes from Jerusalem and two hours from Tel Aviv, offers a refreshing escape with its waterfalls, wildlife, and ancient sites. Here’s your guide to making the most of your visit.

Air Canada apologizes after flight maps erase Israel—Here’s what happened

Air Canada has issued a public apology after passengers discovered that its in-flight maps had replaced Israel with the label “Palestinian territories.”

El Al’s profits skyrocket to $545 million amid price gouging controversy

Israel’s national airline, El Al, has soared to new financial heights in 2024, capitalizing on a near-monopoly over North American routes and posting a net profit of $545 million—4.7 times higher than the previous year.

End of an era: Southwest Airlines to charge for checked bags

Activist investor pressure prompts sweeping changes as the airline, known for its long-standing free checked bag policy, introduces new fare structures that charge most passengers while reserving limited free bag options for top-tier frequent flyers and business travelers

10,000 Haredi draft notices issued by IDF: Shocking enlistment numbers revealed

An IDF representative revealed the shocking numbers of Haredim who actually joined the IDF following the issuing of 10,000 draft notices.

MK Maklev attacks officials: 'You are presenting a distorted picture of Haredim'

Soldiers Humiliated in Bnei Brak Streets, Municipality and Haredi Minister Issue Sharp Condemnations

"On the Baron's Account" - Is the Independence of the Torah World an Opportunity for Prosperity?

Tears amid tragedy: NYC Mayor Eric Adams visits Saada family after unfathomable loss in Brooklyn

Rabbi Buaron: Why Haredim are forbidden to serve in the IDF - even if they don't learn

Haredi hatred knows no bounds: Angered by a social media post, someone decided to change a Haredi's flight - to Shabbat

IDF appeals to religious girls with exemptions to enlist in the military

Kevin Hart’s Vegan Adventure Ends: Hart House Says Goodbye

A Toast to Hart House: While Hart House didn’t go the distance, it sure gave us something to chew on: Even Hollywood’s biggest stars can’t always turn a side gig into a main course.

Good news: This is why chocolate is good for you!

Chocolate has long been a beloved treat, often associated with indulgence and comfort. But what if we told you that chocolate, when consumed in moderation, can actually offer numerous health benefits? The key to enjoying chocolate’s positive effects lies in choosing the right type and consuming it in moderation. Here’s an informative look at why chocolate is good for you, along with some practical tips on how to incorporate it into your diet.

Raising a glass: Israeli winery shines on 2024 top wines list

Flam’s White Label blend beats fierce competition to gain international recognition.

RECIPE: These mini sufganiyot will have your family begging for more

Perfect for your Hanukkah celebration, these mini sufganiyot (traditional Jewish donuts) achieve the impossible: a crispy exterior and cloud-like interior without absorbing excess oil.

AI's dark secret: Major platforms exposed for deep Anti-Jewish bias, claims new report

Moody’s: “Very high political risks have weakened Israel’s economic resilience”

Pro-Palestinian activists slam Google’s $32B Wiz deal: "Merchants of Death"

From start-up to $2.6 billion: NEXT insurance’s jaw-dropping exit shocks tech world

Elon Musk drops bombshell: Pro-Hamas hackers cripple X in massive cyberattack

On Monday, March 10, 2025, Elon Musk, the billionaire owner of the X social media platform, confirmed that the site is grappling with a "massive cyberattack" that has disrupted access for numerous users.

Trump's pushing to dismantle Google – Here's what you need to know

Consumers, caught in the crossfire, face an uncertain future: Will a fractured Google weaken the seamless digital experience they’ve come to expect, as the company claims? Or will it spark innovation stifled by monopoly, as the government contends?

Tesla stock drop shakes up billionaire rankings – Who’s at the top now?

Along with fluctuations in Tesla's stock, the rankings of the world's wealthiest individuals have shifted significantly. Yet out of the top 10 list of richest people in the world half are Jewish and all are men.

Unveiled: How xAI’s Grok3 changed the AI game

Whether you’re a tech geek, a trader, or just someone who loves asking hard questions, Grok 3 is awesome because it delivers answers—and then some. Plus it's not revoltingly PC, which helps.

Understanding the Mandela effect: When everyone clearly remembers something that never happened

Pro-Israel influencer Alix Earle sues Gymshark for $1M after backlash over support for Israel

The science of aging: Can we slow the clock on cognitive decline?

The psychopaths who walk among us - and could you be one of them?!

Overnight: Israel - Netanyahu scraps Shin Bet Pick and Qatargate arrests

Overnight Israel delivers the latest news from Israel as it happens—while you sleep. Get key updates on IDF operations, Israeli politics, and Middle East developments. Stay informed with trusted, fast, and essential coverage to start your day right.

Overnight: Israel - Netanyahu’s Shin Bet Pick and Qatargate Arrests

Overnight Israel delivers the latest news from Israel as it happens—while you sleep. Get key updates on IDF operations, Israeli politics, and Middle East developments. Stay informed with trusted, fast, and essential coverage to start your day right.

WATCH: Overnight Israel – Teen ISIS plot foiled, Netanyahu jets to Hungary, and Hamas kills protester

Overnight Israel delivers the real news from Israel while you sleep. No fluff, no filters—just the facts that matter. From terror plots and protests to Netanyahu’s next move and Trump’s loud diplomacy, here’s what went down while you were dreaming.

WATCH: Erin Molan interviews Jfeed’s Simcha Brodsky in eye-opening conversation about the Gaza Protests

Renowned journalist Erin Molan sits down with Jfeed’s Simcha Brodsky for a rare and revealing studio interview about the latest protests in Gaza. In a role reversal that offers a fresh perspective, the interviewer becomes the interviewee — and the result is a thoughtful, wide-ranging exploration of what’s really happening on the ground.

Stay Updated with Israel News – JFEED

Welcome to JFEED, your comprehensive source for Israel and Jewish world news, offering breaking updates, analysis, and cultural insights.

Why JFEED?

- Real-time Israel political, security, and cultural updates

- Expert commentary and analysis

- Jewish art, traditions, and lifestyle coverage

Comprehensive Coverage

From breaking news to cultural events, JFEED delivers accurate, timely reporting on all significant developments in Israel and Jewish communities worldwide.

Available Everywhere

Access JFEED's mobile-optimized platform across all devices, staying connected to essential news wherever you are.

Join our newsletter to receive updates on new articles and exclusive content.

We respect your privacy and will never share your information.